2021 FICA Tax Rates

Por um escritor misterioso

Descrição

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Taxes – Payroll taxes, especially Social Security, are regressive … NOT !!!

Do You Have To Pay Tax On Your Social Security Benefits?

Federal Insurance Contributions Act - Wikipedia

Federal Insurance Contributions Act - Wikipedia

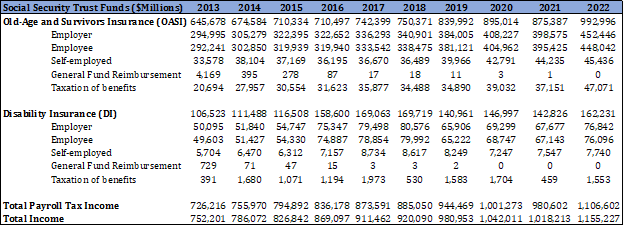

Social Security Financing: From FICA to the Trust Funds - AAF

How to calculate payroll taxes 2021

Withholding FICA Tax on Nonresident employees and Foreign Workers

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Social Security tax impact calculator - Bogleheads

Payroll Tax Rates and Contribution Limits for 2022

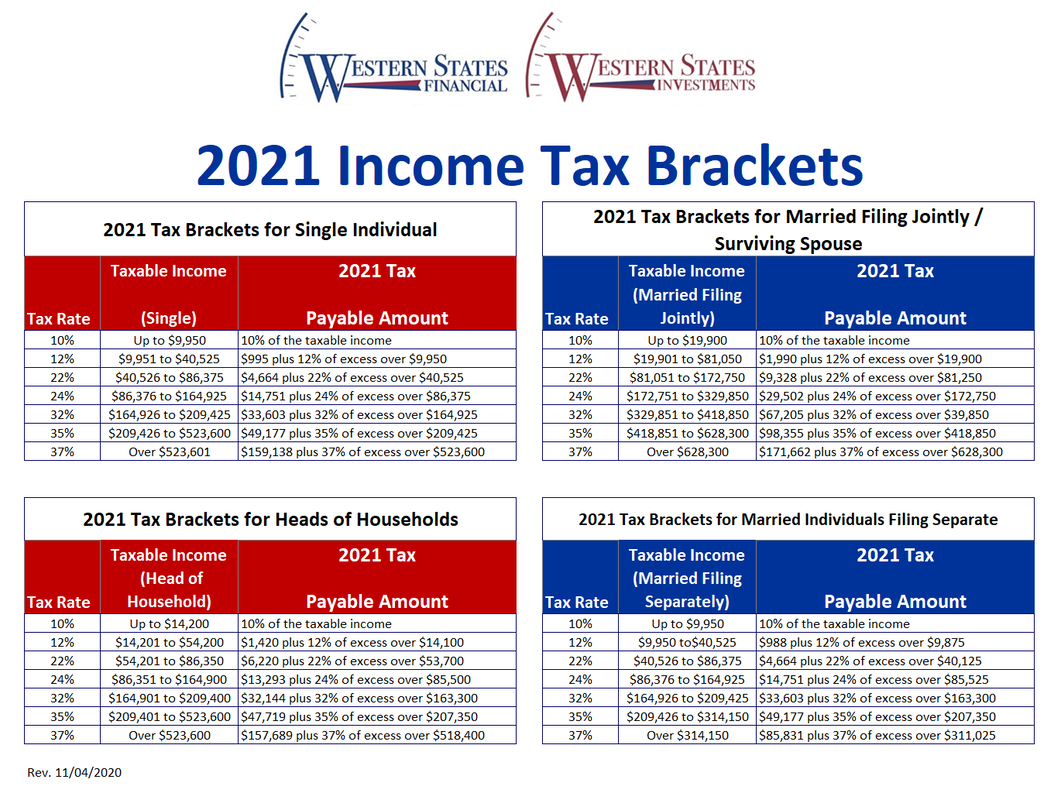

2021 Federal Tax Brackets, Tax Rates & Retirement Plans - Western States Financial & Western States Investments - Corona , CA John Weyhgandt, Financial Coach & Advisor

What is FICA Tax? - Optima Tax Relief

Inflation Spikes Social Security Checks for 2022 - Baker Holtz

Medicare Premiums and Tax Planning - Brownlee Wealth Management

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)