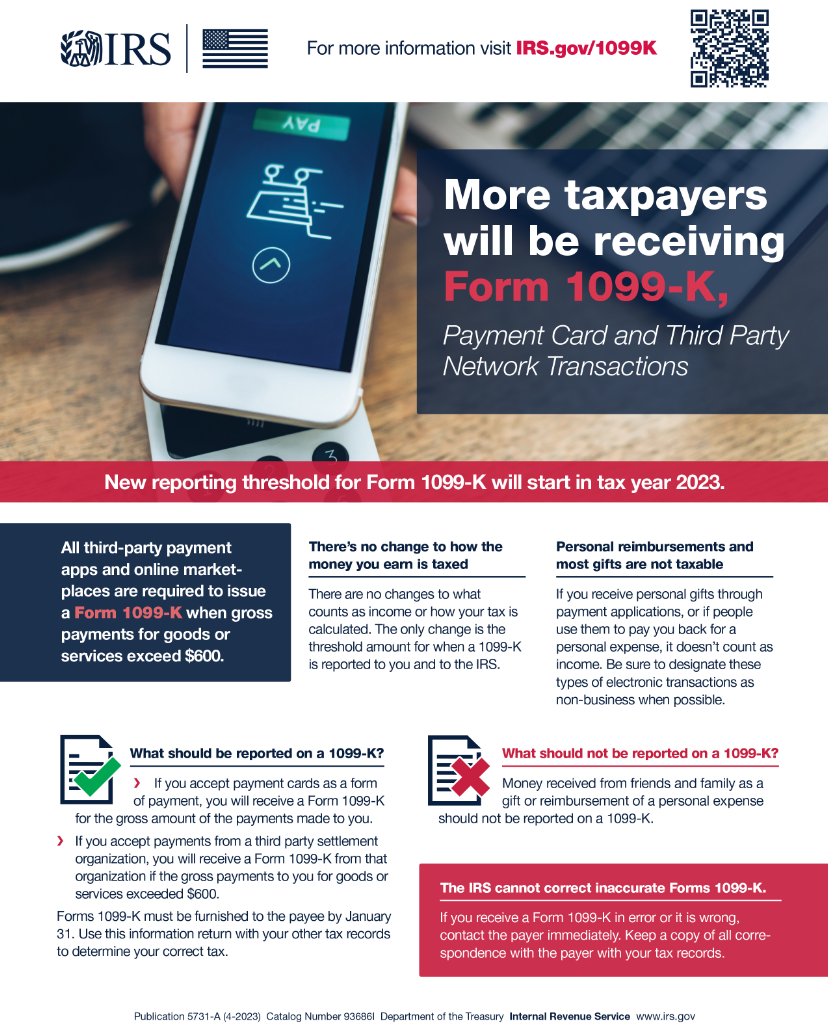

or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Descrição

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

IRS' Venmo crackdown delayed but not dead this holiday season

Sales Taxes Relative To $600 1099 IRS Reporting Th - The Community

IRS Delays For A Year Onerous $600 Form 1099-K Reporting Threshold

IRS Delays $600 Reporting Threshold for PayPal, Cash App (1)

Form 1099-K: Last-Minute IRS Changes & Tax Filing Requirements [Updated for 2024]

IRS will delay $600 1099-K reporting for a year - Don't Mess With Taxes

Petition · Reverse the 1099-k payment threshold for small business back to $20,00 from $600 a year ·

Jobber Payments and 1099-K – Jobber Help Center

New Updates from the IRS on 1099-K Forms: What You Need To Know - 5 Key Things You Should Know

Form 1099-K: Last-Minute IRS Changes & Tax Filing Requirements [Updated for 2024]

Form 1099 Rules for Employers in 2023

Form 1099-K Poster - Utah Association of CPAs

Jobber Payments and 1099-K – Jobber Help Center

Jobber Payments and 1099-K – Jobber Help Center

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/cdn.vox-cdn.com/uploads/chorus_asset/file/10133015/162794739.jpg.jpg)